At Gresham Smith, everything we do is led by our Core Purpose to plan, design and consult to create healthy and thriving communities. An integral part of that is our ESG commitment to understand negative environmental impacts that result from our operations and identifying ways to reduce our carbon footprint as we strive for a healthier, more sustainable and resilient future. We take this commitment seriously and so, we’re proud to be carbon neutral in our business operations for 2022!

This is the result of actions we’ve taken to effectively measure and quantify our 2022 carbon footprint, implement operational improvements to reduce net carbon emissions, and invest in carbon avoidance and removal initiatives to offset remaining emissions. This significant achievement, accomplished earlier than originally planned, is an important milestone on our journey to net zero, and we look forward to continuing to calculate, reduce and offset our carbon footprint annually.

I recently sat down with Lauren Seydewitz, Gresham Smith’s Sustainability and Resiliency Program Manager, and Christie Gamble, Director of Business Development at Cloverly, the organization we partnered with as we worked to achieve carbon neutrality, to discuss our process and next steps.

Rodney Chester: To start our conversation, Lauren, can you explain what carbon neutrality means exactly and walk us through the steps that we took in this process?

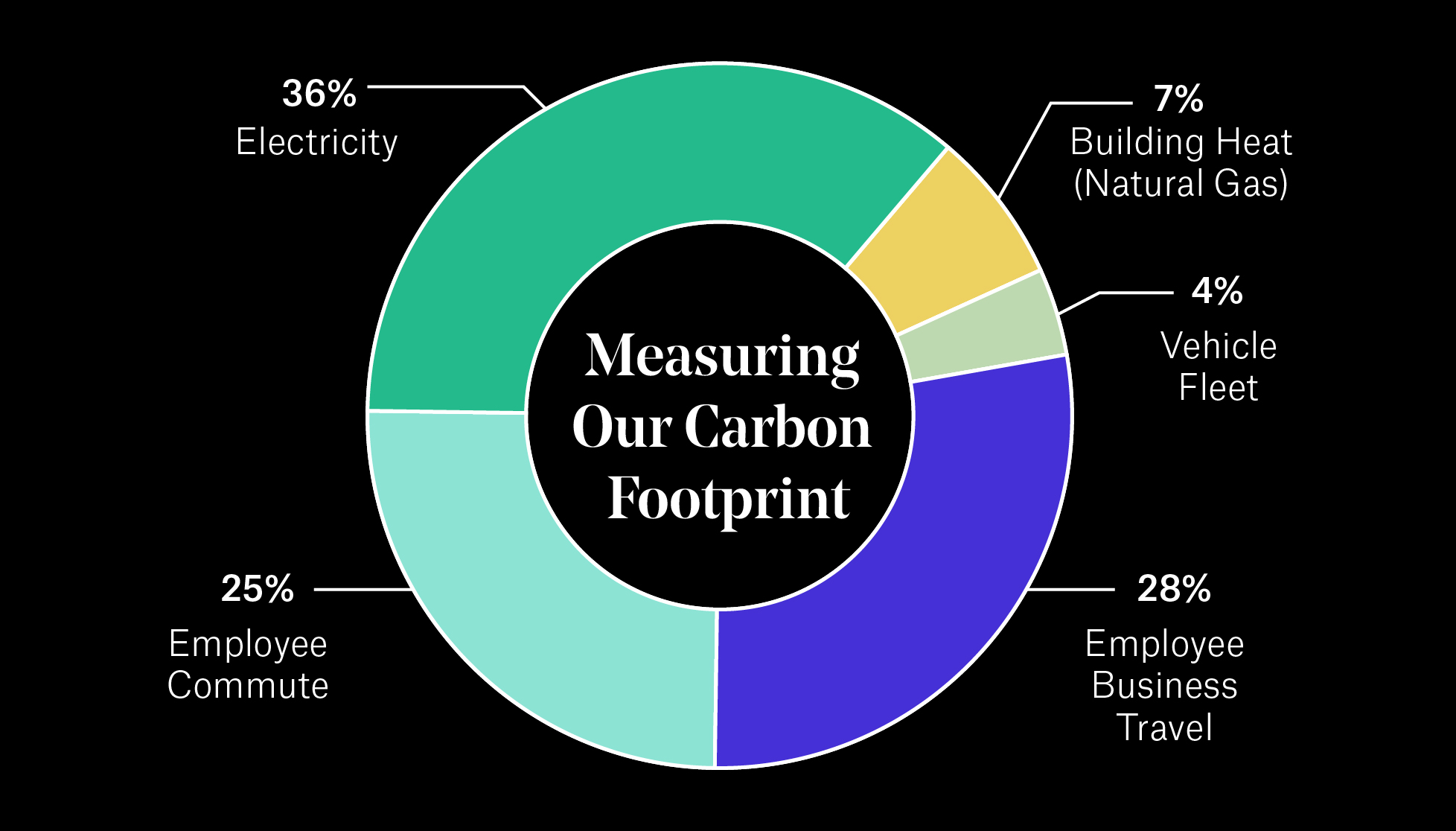

Lauren Seydewitz: Achieving carbon neutrality in our business operations refers to reducing carbon emissions as much as we can, and for any emissions that remain, compensating for them with carbon credits. Similarly to what we do for our clients, the first step in our process was to measure our carbon footprint to understand how our operations produce carbon emissions. The results showed that our emissions sources include three major sources: fossil fuel, electricity and travel.

Fuel—like natural gas, for heating our offices—and gasoline and diesel—which we use in the vehicles we own and drive—are our most significant sources. Since we have control over these sources, they are considered direct emissions during the accounting process. Additionally, we currently purchase electricity for use in each of our offices, so we account for the emissions associated with electricity production. During this baseline inventory, we also included emissions associated with employee commuting and travel.

We found that our total carbon footprint is 5,590 metric tons of carbon dioxide equivalent emissions. Based on our number of employees, that’s 4.88 tons per employee, which is comparable to those of our peer firms.

RC: What are our main action areas that we have focused on to achieve this goal?

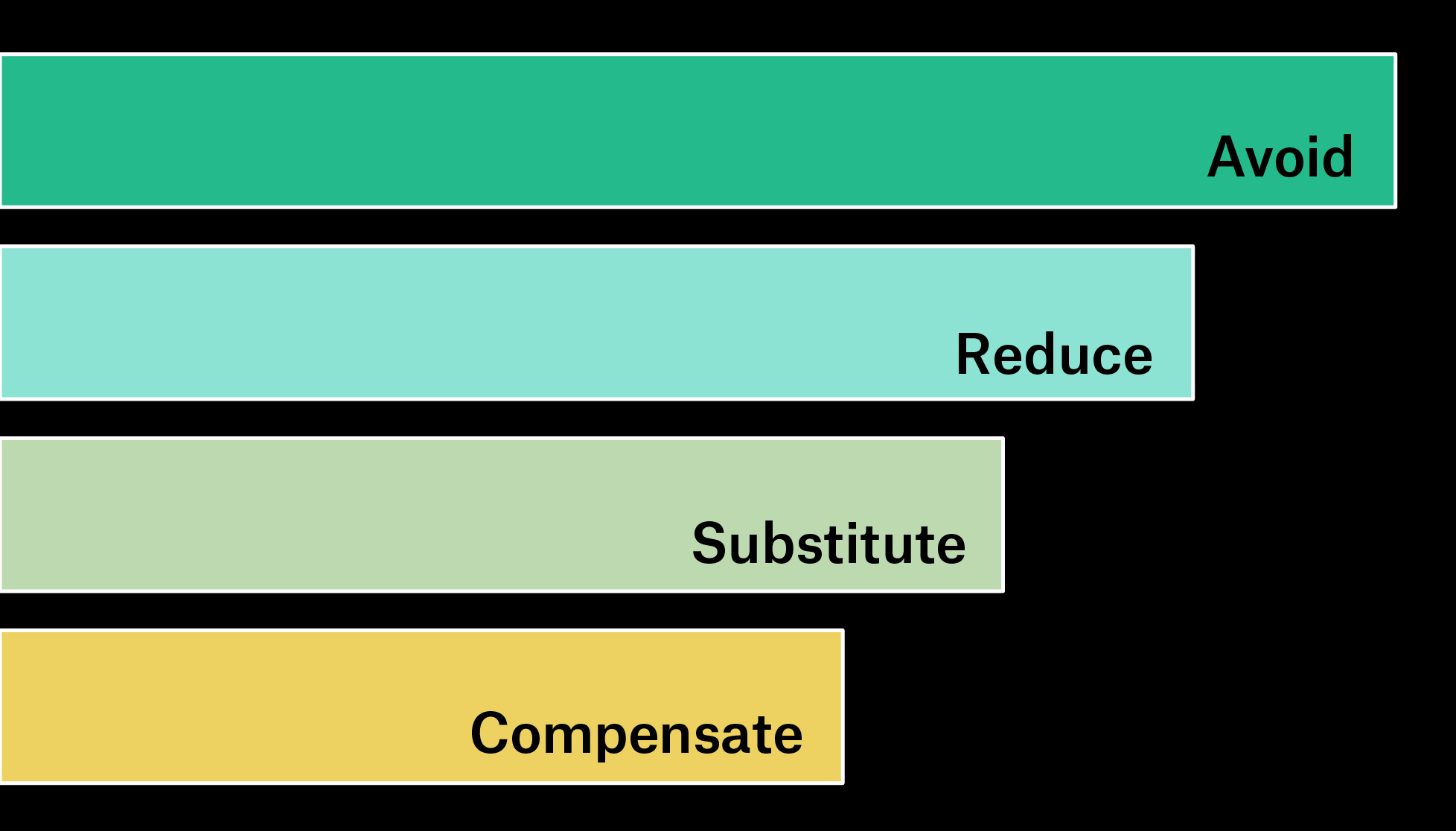

LS: We identified several focus areas within a hierarchy to guide our efforts in ways that achieve the biggest reduction. At the top, which is the area where we have the most control, is avoid/reduce. This refers to the actions we are doing to avoid or reduce emissions from the start, such as using more energy efficient appliances and incorporating energy efficiency into our internal policies and procedures. For example, we are prioritizing these actions as part of our Gresham Smith offices’ LEED certifications.

The next tier focuses on substituting. Our current offices do not have onsite renewable energy, so we are purchasing the equivalent amount of renewable energy we consume from the grid, including solar and wind. Lastly, for remaining emissions, we compensate by investing in carbon credits, which we sought an external partner to assist us in procuring these.

RC: Christie, can you explain how carbon credits work?

Christie Gamble: One carbon credit equals one metric ton of carbon dioxide that has been avoided or removed from the atmosphere. These are tradeable assets that, when done properly, organizations can purchase to “offset” their footprint. Purchasing carbon credits is Gresham Smith’s way of acknowledging the social cost of the carbon emitted through its operations and supply chain, thus taking accountability by investing in projects that promote environmental health.

Ultimately, Gresham Smith is taking steps to reduce its operational footprint overall and the goal is to reach a point where offsetting is not needed because carbon is not emitted. This process takes time, though, so we are investing significant resources to ensure our efforts are making a positive difference right away.

RC: That’s great that we’re able to make a meaningful impact right now. But not all carbon credits are created equal, right?

CG: Correct. There is a wide discrepancy in the quality of credits sold across the Voluntary Carbon Market, and this creates a significant risk for buyers who want to offset emissions. That’s where Cloverly comes in. We’re the leading digital infrastructure powering the voluntary carbon markets and we partner with companies, like Gresham Smith, to advise and apply a robust risk management framework to identify and mitigate potential areas of risk. We evaluate key quality indicators to identify the carbon credits that are delivering the best climate and social impact. We then worked with your team to identify a balanced and diversified portfolio of carbon credits that was meaningful to your firm.

RC: We want to “think globally, act locally,” so it was important that we support projects where we live, work and play when making selections. Can you talk to us about how we selected projects based on that concept?

CG: Of course! Our objective was to develop a portfolio of carbon credits that each achieved different impact goals, and collectively represented Gresham Smith’s values. First, we chose to invest in nature conservation credits that are delivering critical funding to protect biologically diverse and extremely vulnerable forestland in Ohio and Tennessee. Conserving nature is one of the most critical climate actions we can take and it’s imperative that we protect our forests, and the plant and animal species within them. The downside to investing in nature conservation credits, however, is that the carbon impact data can be difficult to measure and has limitations. Striving for optimal impact, the credits we chose use robust measurement and verification processes to quantify their carbon impacts and demonstrate their positive impact on supporting biodiversity and healthy ecosystems.

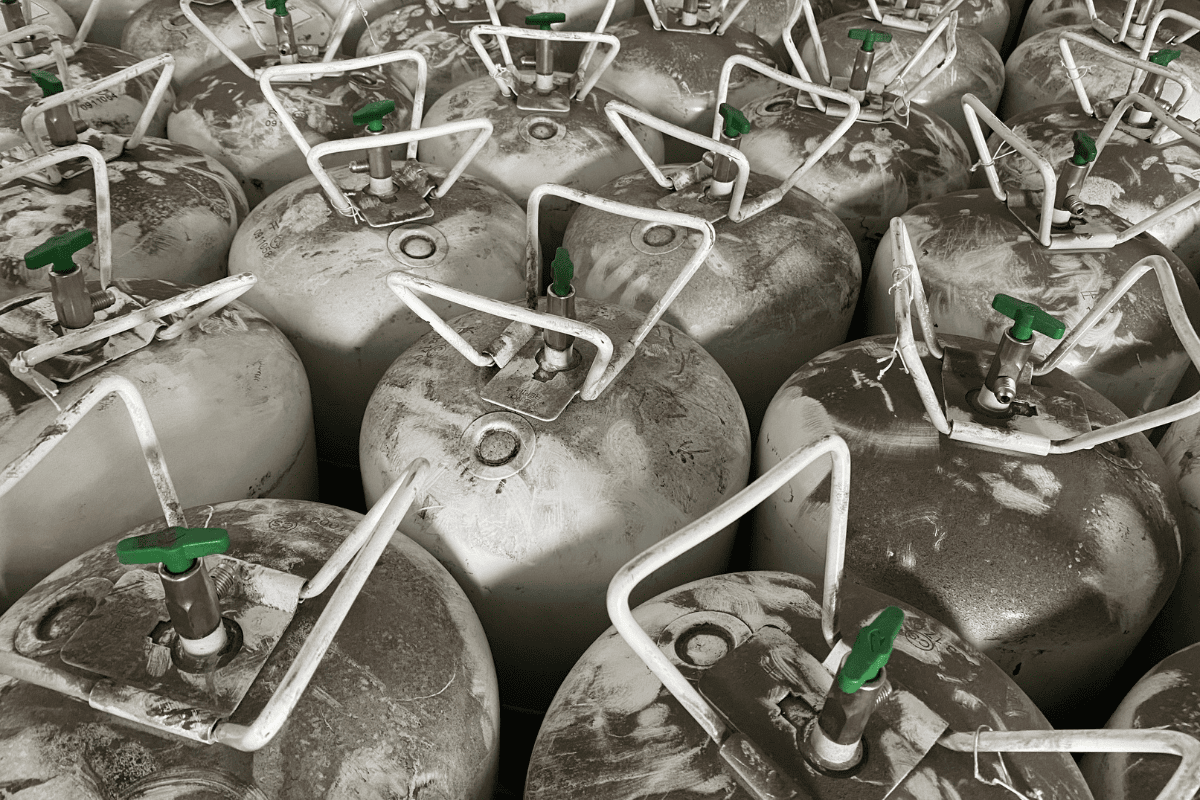

To balance the carbon quantification limitations of nature-based projects, we also selected two refrigerant-based carbon projects operating in North Carolina and Ohio. The first project involves replacing existing refrigerants in commercial food distribution centers with lower GHG emitting processes. The second project is reclaiming highly potent GHGs from discarded refrigerant systems and incinerating those GHGs to ensure they never reach the atmosphere. The key to both projects is that they would not exist if it weren’t for the funding provided by the carbon credit, allowing Gresham Smith to have ample confidence in its carbon neutrality claim.

Finally, we focused on long-term carbon removals — high-quality credits that remove carbon from the atmosphere and store it for hundreds, if not thousands, of years. These projects are located across the U.S. and align with the “ingenuity” aspect of Gresham Smith’s brand. One of the projects, Glanris Biochar from Mississippi, involves converting carbon sequestered from plant sources into a char-type material that’s used to improve soil resilience and enhance crop yields. The process of converting plant waste into biochar ensures the CO2 is removed for hundreds of years. The other, CarbonCure, involves chemically converting waste CO2 into a mineral that is permanently embedded in concrete.

Combined, our intention was to not only help Gresham Smith become carbon neutral, but to also do it in a way that represents Genuine Ingenuity and feels meaningful for all members of the Gresham Smith team.

RC: We’ve really taken the time to create a portfolio that maximizes climate and social impacts for each dollar invested and we appreciate Cloverly’s partnership. Now that we’ve achieved carbon neutrality, what’s next?

LS: We’re very excited about this since it positions us as a leader in the industry. Our work isn’t done yet, though. We will continue to calculate our carbon footprint annually and are committed to finding ways to avoid emissions from our business operations, ultimately seeking to reduce the need to offset emissions as we maintain our carbon neutral status.

RC: Thanks Lauren and Christie. Gresham Smith’s Core Purpose is to create healthy and thriving communities, and to do that we must recognize the way our organization’s carbon emissions impact the environment.

I’m proud of our firm for taking accountability for our existing emissions, implementing solutions to reduce our emissions, and championing projects that offset emissions in the communities where we live, work and play. I encourage everyone to think about what you can do on the personal level to reduce carbon emissions. Small steps can add up to big changes!